Federal tax taken out of paycheck

Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. Beginning in 1950 site selection for public housing.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

For example you may have no withholding tax taken from your paycheck due to how you filled out your W-4 form for the year.

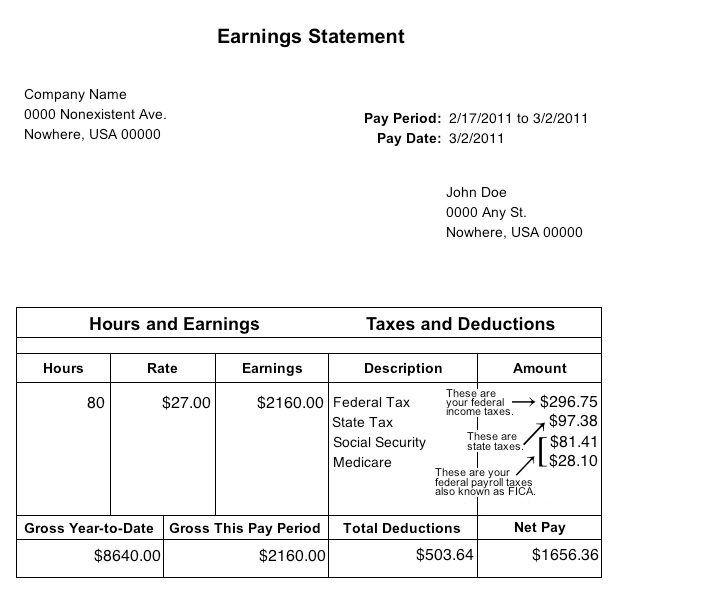

. Learn more about the different taxes on your paycheck including federal state social security and medicare withholding with the experts at HR Block. The amount of tax that is withheld from your paycheck depends on the information you provide your employer with the W-4 form which you fill out when you begin employment for an employer. Child Tax Credit - Tax credit of to 1000 per qualifying dependent child under age 17.

How Do You Calculate Your Federal Income Tax. I am married filing jointly with one dependent. As you can see in the line chart below individual income taxes make up a much larger share of all federal tax revenues than corporate taxes do.

2813 Amount taken out of an average biweekly paycheck. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA. As of 2013 the top 1 of households the upper class owned 367 of all privately held wealth and the next 19 the managerial professional and small business stratum had 522 which means that just 20 of the people owned a remarkable 89 leaving only 11 of the wealth for.

For employees there isnt a one-size-fits-all answer to How much federal tax is taken out of my paycheck However free online tax calculators and learning how payroll taxes work helps understand what take-home pay may look like. Paycheck Protection Program loan forgiveness. If you had no federal tax withheld from your paycheck and need help navigating your taxes get help from HR Block.

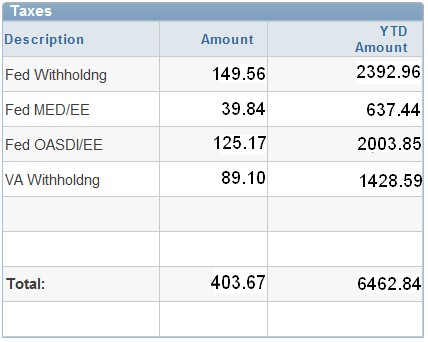

Medicare tax rate for 2019 is 145 for the employee portion and 145 for the employer portion. My employer has no idea why they are not being taken out. The IRS issues more than 9 out of 10 refunds in less than 21 days.

These shifting dates must be taken into account when considering year-over-year deficit comparisons. 215 Amount taken out of an average biweekly paycheck. The other main federal payroll tax is for Medicare.

In both 2020 and 2021 the federal government pushed back Tax Day due to COVID-19. The employers portion of both taxes is deductible on your Federal income tax return which can help to offset the sting of paying both parts of the Social Security and Medicare taxes. On the W-4 you let your employer know whether to withhold tax at the higher single rate or the lower married rate depending on your marital status.

The bill for the wage earners. Employers have the option to use a computational bridge to treat 2019 or earlier W-4s as if they were 2020 or later W-4s specifically for tax withholding purposes. Family or financial obligations might require that you bring home a bigger paycheck each.

H and R block. Self-Employed defined as a return with a Schedule CC-EZ tax form. WASHINGTON The Internal Revenue Service today released an updated Withholding Calculator on IRSgov and a new version of Form W-4 to help taxpayers check their 2018 tax withholding following passage of the Tax Cuts and Jobs Act in December.

One personal exemption of 000 may be taken as a deduction from your gross pre-tax income for yourself if you are. As with Social Security use your gross pay your pay before any taxes are taken out for this calculation. Depending on your location you might pay local income tax and state unemployment tax as well.

For more information see Additional Medicare Tax under Social Security and Medicare Taxes and Self-Employment Tax in. The Withholding Form. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status.

You may be required to pay Additional Medicare Tax. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

The IRS urges taxpayers to use these tools to make sure they have the right. Fastest Refund Possible. Ive had the same same issue for the entire 2021 year so far.

In the United States wealth is highly concentrated in relatively few hands. The fastest and easiest way to make estimated tax payments is to do so electronically using IRS Direct Pay or the Treasury Departments Electronic Federal Tax Payment System. 1 online tax filing solution for self-employed.

Ive tried to talk to IRS reps about why no federal taxes are being withheld from my paychecks and they keep telling me it is my employers responsibility. This too is a flat tax rate. Americas 1 tax preparation provider.

But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit. Your employer most likely takes federal income tax Social Security tax Medicare tax and state income tax out of your paychecks. This came in handy in 1949 when a new federal housing act sent millions of tax dollars into Chicago and other cities around the country.

Not sure why your employer did not withhold any federal or state taxes from your paycheck. The federal withholding tax table that you use will depend on the type of W-4 your employees filled out and whether you automate payroll. Your new employer will use the information you provide on this form to determine how much to withhold from your paycheck in federal income taxes.

IR-2018-36 February 28 2018. See below to learn how to calculate this tax. In 2017 Congress reduced the top corporate tax rate from 35 to 21 where it stands today.

The idea of a regular tax on income much less on wealth does not appear in the. Total income taxes paid. Under federal payroll rules employees are supposed to pay taxes by having them withheld from their earnings unless an exception applies.

Find out with the experts at HR Block. Total income taxes paid. To securely log in to your federal tax account go to IRSgovAccount.

Credit phase-out begins at 110000 for joint. You can have an extra 25 in taxes taken out of. Any income on the excess deferral taken out is taxable in the tax year.

The personal federal tax bill for the top 25 in 2018. You can view the amount you owe review 18 months of payment history access online payment options and create or modify an online payment agreement. Fastest federal tax refund with e-file and direct deposit.

Also you may need to report Additional Medicare Tax withheld by your employer. The TCJA eliminated the personal exemption. The share of federal tax revenue paid by corporations has declined substantially over time.

Because August 1 fell on a weekend this year certain large federal payments that typically pay out on the first of the month were shifted into late July. The estimated tax package includes a quick rundown of key tax changes income tax rate schedules for 2018 and a useful worksheet for figuring the right amount to pay. Tax refund time frames will vary.

672 More From GOBankingRates. Positions taken by you your choice not to claim a deduction or credit conflicting tax laws or changes in tax laws after January 1 2022. Federal Tax Withholding Fed Tax FT or FWT.

Keep in mind that many credits have income limits at which the credit cut off or phased-out. When it comes to Federal Income Tax FIT there are a few. Positions taken by you your choice not to claim a deduction or credit.

Taxes On Paycheck Best Sale 52 Off Www Ingeniovirtual Com

Here S How Much Money You Take Home From A 75 000 Salary

Check Your Paycheck News Congressman Daniel Webster

Tax Information Career Training Usa Interexchange

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Understanding Your Paycheck Youtube

Paycheck Calculator Online For Per Pay Period Create W 4

Decoding Your Paystub In 2022 Entertainment Partners

Understanding Your Paycheck Credit Com

Irs New Tax Withholding Tables

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Taxes On Paycheck Best Sale 52 Off Www Ingeniovirtual Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Taxes Federal State Local Withholding H R Block

Understanding Your Paycheck

Understanding Your Paycheck Direct Deposit Advice Jmu