Investment calculator with increasing contributions

Contribution Limits for IRAs. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

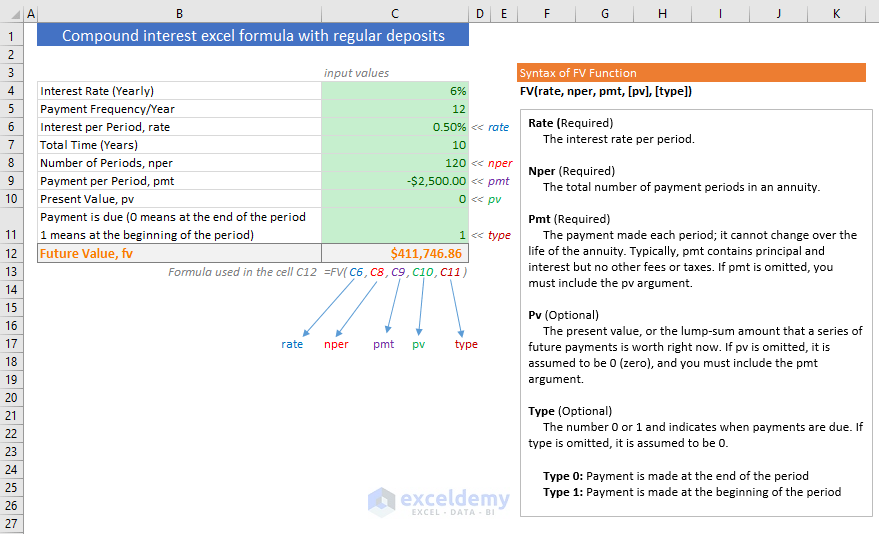

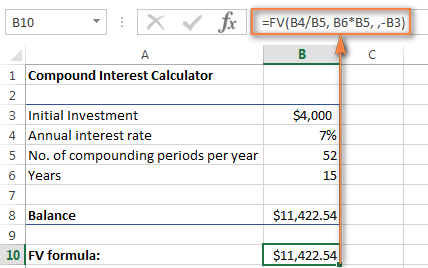

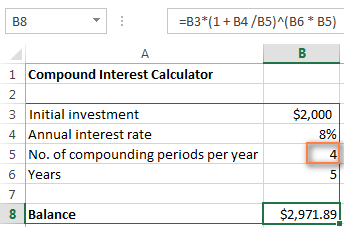

Compound Interest Excel Formula With Regular Deposits Exceldemy

Enroll Now or Increase Contributions.

. Check out the 10 best investment options available with high returns in India. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. How much of my social security benefit may be taxed.

Please see how to read these results below. Compare taxable tax-deferred and tax-free investment growth. Know investment plans such as mutual fund FD PPF NPS.

Investment performance will depend on the growth in the underlying assets which will be influenced. The 2022 contribution limit for both traditional and Roth IRAs is 6000. How can you find extra money to contribute toward your 401k.

Capital gains losses tax estimator. Summary of using 529 plans for college expenses. See the Methodology link below for additional details.

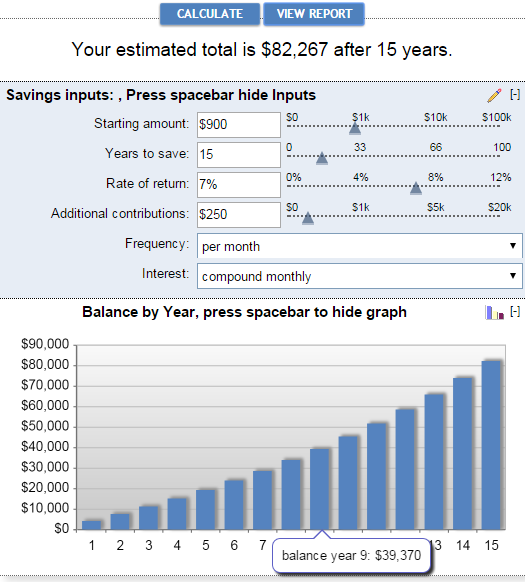

If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. Identify the principal of the investment. Checking Credit Report Monthly has no impact on Credit Score Check Now.

Actual investor performance may differ as a result of the investment date the date of reinvestment and dividend withholding tax. Also pre-tax contributions are subject to the. Will my investment interest be deductible.

While the chances of property prices increasing are very high. Making regular contributions to your account is one of the best ways to increase your income and receive compounding benefit over time. Find out more about your tax relief and pension allowances.

While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes. Annual Dividend Yield is a measure of the annual percentage paid by the security. Allan Gray does not guarantee the suitability or potential value of any information or particular investment source.

All he needs to do is to try and raise his contributions to his 401k plan. The earnings portion of non-qualified withdrawals is subject to federal income tax as well as an additional 10 penalty. Watchful spending and increasing investment corpus every year will also help in building wealth faster.

Should I adjust my payroll withholdings. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Make regular contributions to the existing investment to add potential to compounding.

Planning for retirement takes time and focus to get right. Americans who are 50 or older can contribute an additional 1000 in catch-up contributionsThe IRS stipulates this so those nearing retirement can set aside a bit more. Estimate your potential contributions that can be made to an individual 401k compared to a profit-sharing SIMPLE or SEP plan.

Where applicable any fund rules the contractual terms or fund rules will prevail. This calculator lets you estimate your childs EFC. All figures take account of inflation and show the buying power of your pension in todays money.

Movements in exchange rates may cause the value of underlying international investments to go up or. The earlier you start contributing to a retirement plan the more the power of compound interest may help you save. Please note that your 401k or 403b plan contributions may be limited to less than 80 of your income.

There are many benefits of using a payroll calculator including the ability to estimate your paycheck in advance. Find out how much interest you can save by increasing your mortgage payment. The amount you contribute investment performance and when you retire are some factors that affect the future value of your RRSP.

Use the calculator below to estimate your projected retirement income and how much contributions you need to make per month to achieve your retirement goals. For Monthly Contributions you will enter the amount that you plan to add to your dividend investment each month. Financial aid eligibility is based on a students financial need which is the difference between the colleges Cost of Attendance COA and the students Expected Family Contribution EFC.

This is the amount of your initial investment. You can also use the same tool to calculate hypothetical changes such as withholding more money from each paycheck or increasing your retirement contributions. Corporate finance is the area of finance that deals with sources of funding the capital structure of corporations the actions that managers take to increase the value of the firm to the shareholders and the tools and analysis used to allocate financial resources.

For example imagine your principal in an investment account is 5000. Federal tax-free treatment of 529 plans applies to any funds withdrawn to cover qualified higher education expenses QHEE or K-12 tuition. 2022 Immediate Annuity Rates Immediate Annuity Income Quote Calculator Whats an Immediate Annuity SPIA DIA QLAC.

The EFC is calculated based on the income asset and demographic information reported on the Free Application for Federal Student Aid FAFSA. The sooner you start making a retirement plan the more money you can save and invest for the long term. The big difference between traditional IRAs and Roth IRAs is when taxation is applied.

Likewise you can be rich someday by increasing contributions to your 401k. Adjust your contributions or predicted investment performance to see the effect they have on your RRSP value. The formers contributions go in pre-tax usually taken from gross pay very similar to 401ks but are taxed upon withdrawal.

How much self-employment tax will I pay. Keep in mind. 2022 federal income tax calculator.

Use our retirement calculator to see how much you might save by the time you retire based on conservative historic investment performance. In the calculation the interest rate will have to be input as decimal. This could be how much you deposited into the account or the original cost of the bond.

In contrast Roth IRA contributions are deposited using after-tax dollars and are not taxed when withdrawn during retirement. The impact on your paycheck might be less than you think. Years invested 65 minus your age.

Determine how far your investment goes after taxes interest and inflation. Returns Contributions and more. The compound interest calculator gives the total investment wealth gained and maturity value both in number and in graphical format.

Be sure to verify the maximum contribution rate allowable under your plan. Benefits of Using a Payroll Calculator. Use Forbes Advisors.

Whether his employer decides to match his contribution doesnt control his final outcome or the amount of growth his money will achieve. The primary goal of corporate finance is to maximize or increase shareholder value. When you are shopping for immediate annuity rates or immediate annuity quotes it is good to understand that this is the most fundamental pure form of an annuitySingle Premium Immediate Annuities acronym SPIA date back a couple of.

Our RRSP calculator uses these inputs to estimate how much your RRSP could be worth in the future.

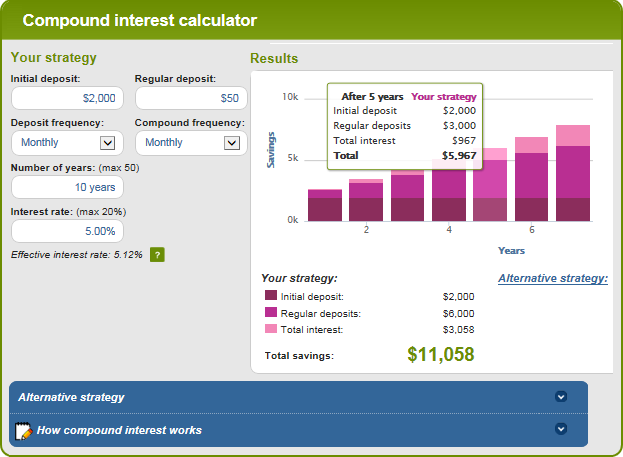

Compound Interest Calculator Daily Monthly Quarterly Annual

Investment Calculator Learn Investment Formula

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator Daily Monthly Yearly

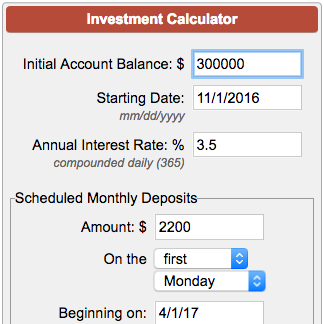

Increased Contribution Impact Calculator Agfinancial

Investment Account Calculator

Excel Investment Calculator Myexcelonline

Customizable 401k Calculator And Retirement Analysis Template

Compound Interest Calculator Daily Monthly Yearly

Walletburst Compound Interest Calculator With Monthly Contributions

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator Daily Monthly Quarterly Annual

What Is The Best Roth Ira Calculator District Capital Management

Free 401k Calculator For Excel Calculate Your 401k Savings

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel